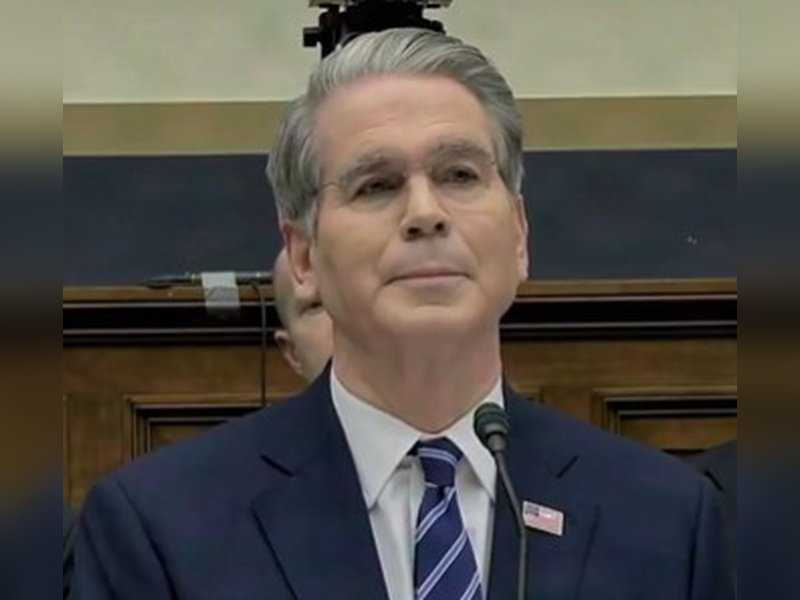

Washington, Feb 6 (IANS) The US Treasury is betting that stablecoins backed by government securities can strengthen the global role of the dollar, with Treasury Secretary Scott Bessent defending new legislation on digital assets before Congress.

Testifying before the Senate Banking Committee, Bessent praised the GENIUS Act, which requires stablecoins to be backed by high-quality liquid assets such as US Treasuries.

“This framework has the potential to expand dollar dominance, increase global demand for dollar-denominated assets like US treasuries, reduce systemic risk and support economic growth and innovation,” said Chairman Tim Scott.

Bessent said stablecoins could become an important source of funding for the US government. “We believe that with the US having the safest, soundest best practices, we can draw in new sources of funding via the stablecoin mechanism,” he said.

Republican lawmakers said the law would keep innovation onshore. Senator Bill Hagerty said it would help maintain the dollar’s central role in the global financial system.

Bessent warned against the rise of central bank digital currencies overseas. “We are going to see a choice between American private sector assets with our best practices in regulation or between central bank digital assets,” he said.

“And I think the world is going to choose the US dollar,” Bessent added.

Democrats raised concerns about financial stability and consumer protection, but Bessent said proper regulation would prevent risks. “We don’t want to have central bank digital assets,” he said, arguing for a private-sector led model.

The Treasury secretary said agencies are working to ensure stablecoin growth does not trigger deposit volatility at community banks.

“We will continue to work to make sure that there is no deposit volatility associated with this,” Bessent said.

Digital assets and stablecoins are closely watched in India, where policymakers and regulators have taken a cautious approach while monitoring global developments.

India’s fintech sector and IT firms with exposure to global payments systems track US policy closely, as shifts in dollar-based digital finance could affect cross-border transactions.

The Senate hearing highlighted bipartisan interest in providing regulatory clarity for digital assets while maintaining US financial leadership.

Treasury officials said further work on crypto market structure legislation is expected later this year.

--IANS

lkj/rs