Washington, Dec 17 (IANS) A bipartisan group of US senators introduced legislation aimed at imposing financial sanctions on foreign entities that continue to purchase Russian oil, seeking to choke off a major source of revenue for Moscow’s war effort in Ukraine.

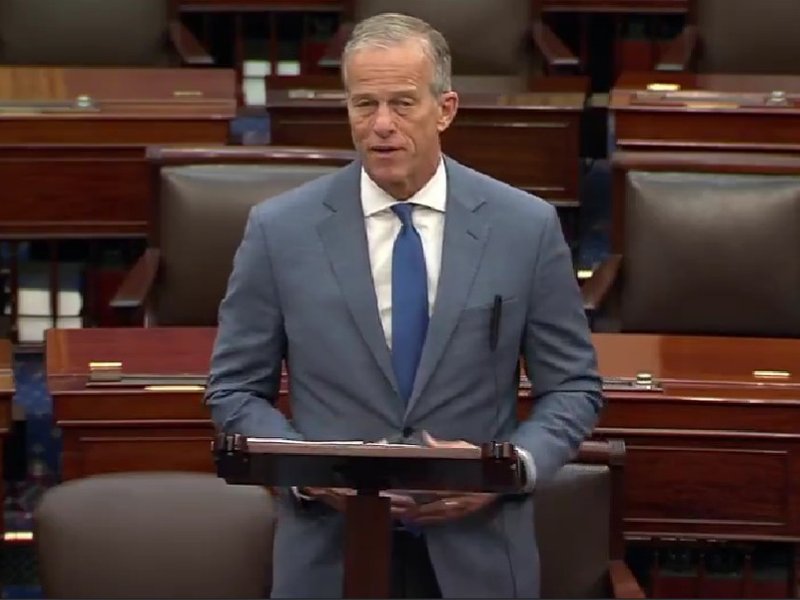

The Decreasing Russian Oil Profits (DROP) Act of 2025, introduced by Sen. Jon Husted, a Republican from Ohio, alongside Sens. Dave McCormick of Pennsylvania, Elizabeth Warren of Massachusetts, and Christopher Coons of Delaware, authorizes the US government to sanction foreign persons found to be directly or indirectly involved in buying Russian petroleum products.

“This bill sends a clear message to the world that there will be consequences for continuing to buy Russian oil,” Senator Jon Husted said, adding that Congress would “no longer tolerate the hypocrisy of nations that condemn Vladimir Putin’s actions on the world stage while funding his war machine through shady oil purchases.”

Under the proposed legislation, countries could receive limited exemptions from sanctions under a narrow set of conditions, including providing military or economic assistance to Ukraine. The measure also seeks to encourage U.S. allies and trading partners to reduce dependence on Russian energy supplies.

“If our allies and trade partners want to purchase oil, they can buy American,” Husted said. “For those countries that insist on buying Russian, this bill will encourage them to step up and provide support to Ukraine.”

Supporters of the bill pointed to continued global demand for Russian oil despite sanctions imposed since Moscow’s invasion of Ukraine. China, India, Turkey, and Iran, including through so-called ghost fleets, are among the largest consumers of Russian oil.

A media release noted that while nearly every European nation has provided aid to Ukraine, several European countries still purchase oil from the Kremlin, helping finance Russia’s war.

McCormick said continued purchases of Russian oil directly undermine efforts to end the conflict. “Any nation or entity that buys Russian oil is actively funding Russia’s aggression in Ukraine,” he said. “Putin has demonstrated he is unserious about bringing this war against Ukraine to a close, and continuing to fuel the war machine should carry consequences.”

Warren emphasized the bill’s focus on access to the US financial system as a form of leverage. “No matter how the Kremlin tries to reshuffle its exports to evade our measures, anyone who helps facilitate imports of Russian-origin oil risks losing access to the US financial system,” she said, adding that the United States must show it can “sustainably drive up the costs for Russia as Putin continues his brutal war of choice.”

Coons framed the legislation as both a moral and strategic step. “Putin will only stop when we stop him,” he said, accusing Russia of using oil profits to fund a war that has seen “Russian torture and kill civilians, kidnap children, and threaten democracy.” He said the bipartisan bill would “cut off Putin’s lifelines by targeting the true buyers of Russian oil.”

The DROP Act directs the Department of the Treasury to impose sanctions on foreign persons determined to be responsible for, complicit in, or knowingly facilitating the purchase of Russian petroleum products.

This includes entities owned or controlled by such purchasers, or those acting on their behalf.

The bill outlines four possible exemptions, with countries required to meet at least two to avoid sanctions.

These include isolating funds earned from Russian oil sales for humanitarian use while reducing purchases, depositing payments per barrel into a special account for Ukraine’s benefit, providing “significant economic or military support” to Ukraine, or importing oil from specified Russian ports for a limited period following enactment.

--IANS

lkj/rs